Working hard in the background...

6 Ways to Use Credit Cards to Build Long-Term Wealth in Canada

Published Dec 8, 2025 1:15 PM • 6 min read

Credit cards are perfect for quick purchases, allowing you to borrow money immediately and pay it off later. But did you know that your credit card can also help you effectively grow your net worth?

By applying for the right card, strategically collecting and redeeming rewards, and taking advantage of special promotional offers, you can multiply your money as you spend it.

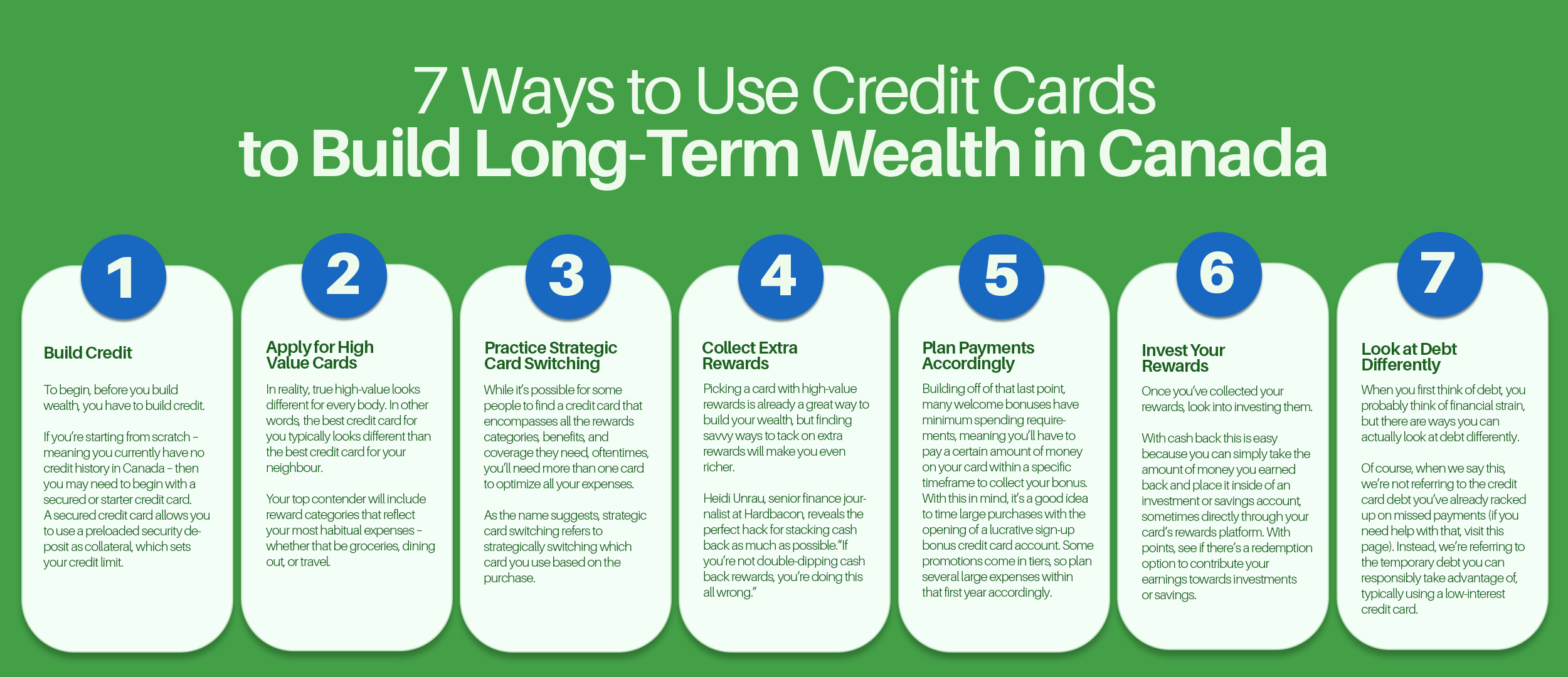

In this post, we’ll reveal 7 ways to use credit cards to build long-term wealth in Canada. Stick around for all the expert tips!

1. Build Credit

To begin, before you build wealth, you have to build credit.

If you’re starting from scratch – meaning you currently have no credit history in Canada – then you may need to begin with a secured or starter credit card. A secured credit card allows you to use a preloaded security deposit as collateral, which sets your credit limit. Starter cards are made for beginners (including students or newcomers to Canada) and they generally are less strict about credit checks prior to approval.

Regardless of which kind of card you choose, you’ll build positive credit by paying off your balances on time and keeping your credit utilization ratio low (typically below 30%).

Building your credit health allows you to apply for more high-value credit cards in the future. High-value cards have better credit limits, rewards, and benefits.

2. Apply for High-Value Cards

In reality, true high-value looks different for every body. In other words, the best credit card for you typically looks different than the best credit card for your neighbour.

Your top contender will include reward categories that reflect your most habitual expenses – whether that be groceries, dining out, or travel. Ideally, the card’s benefits and coverage categories will also complement your lifestyle. For instance, if you’re a traveller, you might want a card with benefits like airport lounge access, plus coverage like trip interruption and trip cancellation insurance.

If the card in question comes with an annual fee, you’ll want to make sure you earn as many rewards as possible and use up all the benefits and coverage you can to fully offset the yearly cost.

With cash back credit cards, you’re essentially putting a percentage of money back into your pocket with each eligible purchase – so it’s best to browse complementary cards with the highest cash back rates.

For points, things get a bit trickier. Each loyalty program establishes its own value per point and this value can change depending on which redemption category you choose. Basically, to extract the most value out of your points, you’ll want to focus on redeeming your points towards the highest-value redemption categories.

Sometimes, you can also transfer your points to other popular loyalty programs. For example, you can transfer your American Express Membership Rewards points to Aeroplan at a 1:1 ratio.

Generally, you’ll find that travel is the highest redemption category among credit cards that offer it. That said, redeeming your points for popular expenses like flights across multiple booking platforms can be tedious – that’s where third-party cross-search tools like Point.me and Pointhound come in. These tools filter through all the flight deals for you and compile a list of the best value bookings.

Read More: How to Optimally Redeem Your Credit Card Points

3. Practice Strategic Card Switching

While it’s possible for some people to find a credit card that encompasses all the rewards categories, benefits, and coverage they need, oftentimes, you’ll need more than one card to optimize all your expenses.

As the name suggests, strategic card switching refers to strategically switching which card you use based on the purchase. For example, you might have an “everyday credit card” that you use to earn rewards on your daily errands like gas and groceries but a travel-specific credit card to pay for trips. There are also store-branded credit cards that optimize the purchases you make at specific retailers you frequent.

Read More: Strategic Credit Card Switching

4. Collect Extra Rewards

Picking a card with high-value rewards is already a great way to build your wealth, but finding savvy ways to tack on extra rewards will make you even richer.

Heidi Unrau, senior finance journalist at Hardbacon, reveals the perfect hack for stacking cash back as much as possible.“If you’re not double-dipping cash back rewards, you’re doing this all wrong.” In her featured article, she suggests that spenders use their credit cards to purchase items through cash back apps – and we couldn’t agree more! “Double that income stream or go home,” adds Unrau.

You can also earn extra cash back with credit cards alone by adding authorized users or having your partner apply for the same or another high-promotional-offer credit card to pocket two welcome bonuses.

Based on the restrictions that many banks put in place in order to deter credit card churning, perks like credit card welcome bonuses are often limited to one person per lifetime (or at least for an extensive period of time). That said, there are still some ways you can squeeze the most value out of those intro offers.

On The Wealthy Barber podcast, award-winning personal finance and credit card rewards expert, Barry Choi, talks about how you can optimize credit card sign-up bonuses, particularly within a multi-person household. “If there are two people in your family, like two parents, and you’re each getting, say, two credit cards a year ... you could easily earn 150 to 200,000 points without much effort.”

Keep in mind, however, that earning these extra points will likely require extra spending.

5. Plan Payments Accordingly

Building off of that last point, many welcome bonuses have minimum spending requirements, meaning you’ll have to pay a certain amount of money on your card within a specific timeframe to collect your bonus. With this in mind, it’s a good idea to time large purchases with the opening of a lucrative sign-up bonus credit card account. Some promotions come in tiers, so plan several large expenses within that first year accordingly.

6. Invest Your Rewards

Once you’ve collected your rewards, look into investing them.

With cash back this is easy because you can simply take the amount of money you earned back and place it inside of an investment or savings account, sometimes directly through your card’s rewards platform. With points, see if there’s a redemption option to contribute your earnings towards investments or savings. For instance, the BMO Rewards program allows you to redeem points towards financial products, like a BMO savings or investment account.

You can also invest your rewards into stocks, ETFs, businesses, or real estate. But if you don’t want to overcomplicate things, you can always stick to investing in yourself. Investing in yourself might mean contributing to a savings account through a HISA (High-Interest Savings Account) or a TFSA (Tax-Free Savings Account). You can build your wealth through your RRSP (Registered Retirement Savings Plan). If you’re just starting out, consider taking advantage of a First Home Savings Account (FHSA).

How does investing your credit card rewards into a savings account help you build long-term wealth?

The answer is compound interest.

Compound interest works by earning you interest on your saved balance and previously collected interest.

Femi Orenuga, a finance coach and educator with years of experience in wealth management, stresses the importance of compound interest in a previous LinkedIn post. “Think of compound interest like a snowball rolling down a hill, starting small and growing bigger and bigger over time … that’s the magic of compounding.” With low-interest rates on average, this growth might seem insignificant, but Orenuga assures Canadians that “over time, those small gains can turn into something huge.”

Conclusion

Now that you’re well-versed on how to use credit cards to build long-term wealth, it’s time to put these tips into practice:

- First, build up enough credit to apply for a high-value credit card that complements your spending habits.

- Use that credit card to collect as many rewards as possible. Consider having authorized users on your account, purchasing from brands featured on cash back rebate programs like FinlyBoost, or by having your partner apply for the same or another high-promotional-offer card as a primary user to take full advantage of intro incentives.

- Once you’ve accumulated tons of rewards, redeem them towards high-value redemption categories, or put them towards financial products like a compounded savings account.

- If you’re feeling particularly adventurous, you can also use your card to flip products and make a profit, especially if you responsibly optimize a low-interest or no-interest promotional period.

Frequently Asked Questions

When used strategically, credit cards can absolutely boost your savings. When you apply for the right card, collect as many rewards as possible, and redeem those rewards wisely (specifically towards investments or financial products), you can increase your net worth over time. Use your cash back by placing it directly into a savings account. Alternatively, you can sometimes redeem your points toward financial products (this is the case for loyalty programs like BMO Rewards).

If you’re a newcomer to Canada or a student who’s just starting their financial journey, you can always opt for a secured card or a starter card. A secured credit card uses a refundable deposit to set your credit limit. Starter cards are beginner-friendly and often avoid credit checks for approval. No matter which card you choose, make sure to pay your balances on time and keep your utilization ratio low to promote a positive credit history.

The first way to maximize your credit card rewards is to select a card that matches your spending habits. So, if you’re a big traveller, you’ll want a travel credit card, for example.

You can also use strategic card switching to make the most out of your rewards. Let’s say you have a travel card for your frequent trips, but you also want to optimize your gas and groceries as much as possible. In this case, you can supplement a premium travel card with an everyday-earnings credit card.

Collect even more rewards using a cash back app or extension (like FinlyBoost) on top of using a qualifying reward-accumulating credit card at checkout.

Additionally, add some authorized users to your account or have your partner apply for the same (or another high-earning) card as a primary user – this way, you can take advantage of two welcome bonuses!

It’s always best to pay your balance in full by every due date. However, you can use low-interest or 0% interest promotional credit card offers strategically to fund short-term money-making projects like flipping products – just make sure you can repay your balance before the promotional period ends!

Trending Offers

Tangerine® Money-Back World Mastercard®*

Tangerine Money-Back Mastercard

BMO Performance Chequing Account

Scotiabank Passport® Visa Infinite* Card

About the author

Sara Skodak

Lead Writer

Since graduating from the University of Western Ontario, Sara has built a diverse writing portfolio, covering topics in the travel, business, and wellness sectors. As a self-started freelance content ...

SEE FULL BIOAbout the editor

Lauren Brown

Editor

Lauren is a freelance copywriter with over a decade of experience in wealth management and financial planning. She has a Bachelor of Business Administration degree in finance and is a CFA charterholde...

SEE FULL BIO