How Inflation Affects Canadian Credit Card Interest Rates

Published July 1, 2025

•

Last updated August 7, 2025

5 min read

Inflation has become a hot topic in Canada over the past few years. The cost of groceries has climbed, rent has increased, and even basic day-to-day spending has become more expensive. But what about credit card debt and inflation in Canada? How are they linked? You may be surprised to learn that inflation can drive up credit card interest rates. If you carry a balance on your credit card, rising rates can make it much harder to manage debt. In this guide, we’ll break down exactly how inflation impacts credit card interest rates in Canada, why rates rise, and what steps you can take to protect your finances.

What Is Inflation?

Inflation occurs when the cost of goods and services goes up over time. As prices rise, each dollar buys a little less than it did before. This effect is called a decline in purchasing power.

Statistics Canada measures inflation using the Consumer Price Index (CPI), which tracks the cost of items like food, gas, housing, and transportation. Over the past few years, Canadian inflation has been higher than normal. For example, in the year 2022, inflation in the country reached 8.1% — a level not seen in 39 years. Before the Covid-19 pandemic, annual inflation was around 2%.

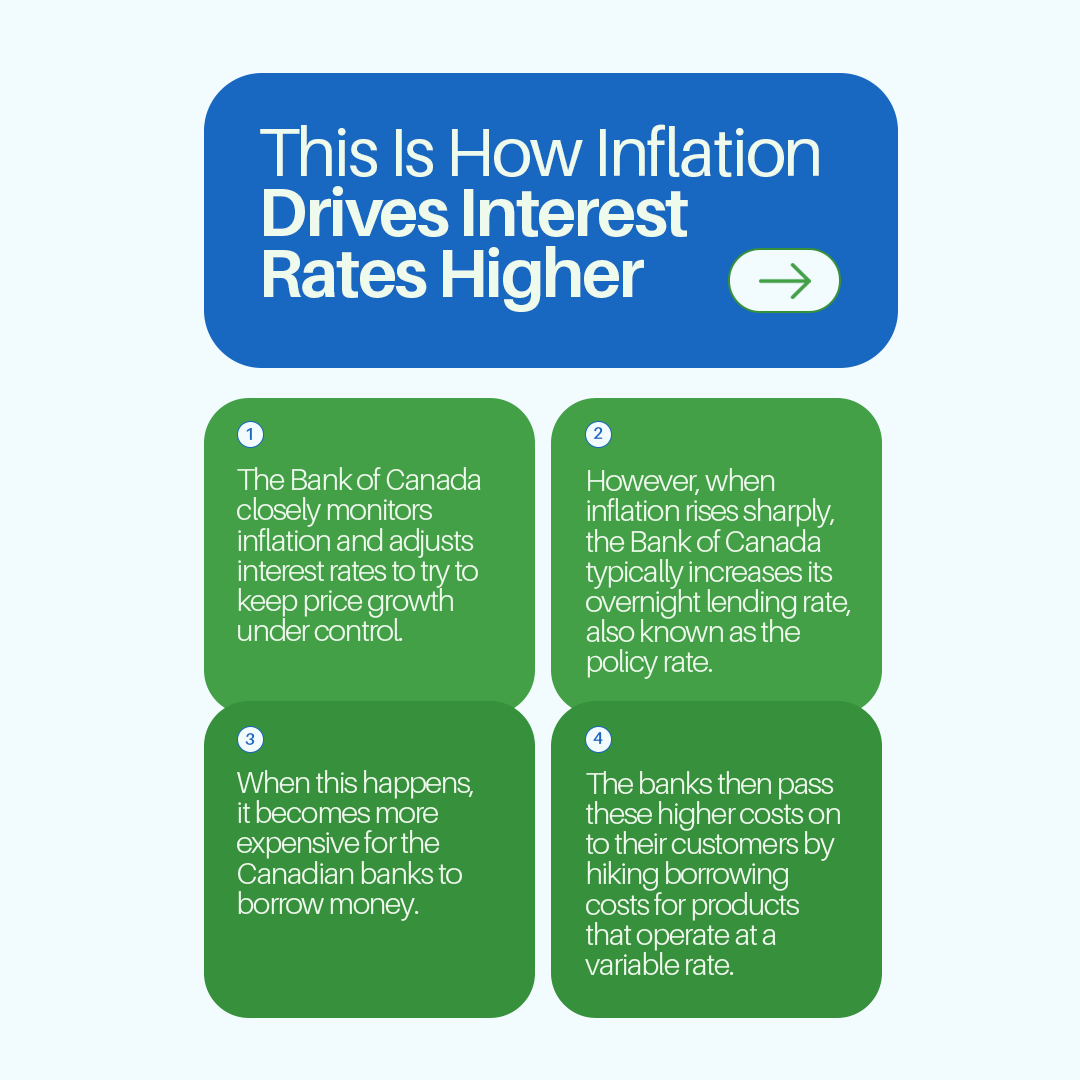

How Inflation Drives Interest Rates Higher

The Bank of Canada closely monitors inflation and adjusts interest rates to try to keep price growth under control. However, when inflation rises sharply, the Bank of Canada typically increases its overnight lending rate, also known as the policy rate. When this happens, it becomes more expensive for the Canadian banks to borrow money. The banks then pass these higher costs on to their customers by hiking borrowing costs for products that operate at a variable rate.

So, what does this mean for interest rates on Canadian credit cards? It means inflation and credit card interest rates in Canada are directly linked if the card charges a variable interest rate. To find out if your card charges a variable or a fixed interest rate, check your credit card agreement.

Typically, Canadian cards charge a fixed interest rate. This means that credit cards don’t see their interest rates fluctuate month to month based on the Bank of Canada’s lending rate. However, your interest costs can change even if you have a fixed interest rate on your credit card. In Canada, financial institutions are legally allowed to change the rate on fixed products provided that they inform you in writing 30+ days in advance.

Why Credit Card Interest Rates Are Sensitive to Inflation

Credit cards typically carry some of the highest interest rates among all forms of consumer debt. RBC reports that standard Canadian credit card annual percentage rates (APRs) often range between 19.99% and 25.99%. The reason for this? It’s because credit cards are unsecured debt, meaning lenders have no collateral if a borrower defaults. To compensate for that added risk, banks build several layers into the interest rate:

· Base cost of borrowing

· Inflation adjustment

· Risk premium

· Profit margin

The result? Credit cards can quickly become one of the most expensive forms of debt during an inflationary period.

Impact on Canadian Households

To better understand this concept, let’s look at an example:

Imagine that you have a $5,000 balance on a credit card with an APR of 19.99%. At this rate, you’ll pay roughly $83 in interest each month if you make only minimum payments.

Now, let’s say that same card sees an increase in its interest rate to 24.99% due to inflation. Suddenly, your monthly interest jumps to about $104 for an additional $21. Over a year, that equates to over $250 in extra interest charges! That’s a big difference, isn’t it?

For many Canadians already feeling the pinch from higher grocery bills, elevated fuel prices, and rent hikes, this added debt burden can quickly escalate. Equifax reported that younger Canadians and lower-income households are already seeing a higher level of missed payments, an early warning sign that more people are struggling to keep up.

Strategies to Protect Yourself From Rising Credit Card Rates

The good news? You’re not powerless against rising credit card rates. Even in an inflationary environment, there are several steps you can take to minimize the impact of higher rates. Consider:

· Paying off your balances in full: The simplest (and most effective) way to avoid credit card interest is to pay your entire balance every month. Yes, pay more than the minimum! If you don’t carry a balance, rising rates won’t affect you at all.

· Negotiating a lower interest rate: Wondering “how to lower credit card interest?” Many Canadians don’t realize they can contact their bank and request a lower interest rate on their credit card. If you’ve been a loyal customer with a sound payment history, your lender may be willing to work with you.

· Using balance transfer offers: Credit cards may offer promotional balance transfer rates, sometimes at a rate of 0% for a set period of time. Transferring high-interest debt to a lower-rate card can help you pay down your balance faster because you save on interest!

· Consolidating debt: If you carry multiple balances across several credit cards, consider consolidating your debt into a lower-interest personal loan or line of credit. This can simplify payments and reduce overall interest costs.

· Building an emergency fund: Having savings set aside for unexpected expenses helps reduce your reliance on credit cards when surprise bills hit.

· Seeking professional help (if needed): If you’re feeling overwhelmed, credit counseling services can provide personalized advice and help you create a realistic debt repayment plan.

Will Credit Card Rates Go Down When Inflation Cools?

A common question Canadians have is: “Once inflation calms, will credit card rates come back down?” Unfortunately, credit card rates don’t always follow inflation in both directions. While lenders may reduce rates somewhat, credit card APRs often stay elevated. This is because lenders have multiple considerations beyond inflation. These include borrower defaults, credit market conditions, and profit targets.

With no legal requirements or caps on credit card interest rates, the best defense for consumers is to use credit wisely.

Final thoughts

Inflation doesn’t just affect your daily spending, it can also creep into your borrowing costs. When inflation climbs, the Bank of Canada often increases its policy rate, which, in turn, raises the cost of borrowing for Canadian banks. Typically, these financial institutions transfer elevated borrowing costs to their customers in the form of higher interest rates. Even fixed-rate credit cards are not immune, with the banks requiring only 30 days notice before changing the APR.

Understanding how inflation affects credit card interest rates in Canada can help you take control of your finances. The second step is taking action, whether that is reviewing your current card terms, switching to better options, or creating a debt repayment plan that works for you. You have control! By making full payments, limiting high-interest debt, and exploring lower-cost options like low interest balance transfers or debt consolidation, you can protect your finances, even when inflation spikes.

Looking for more ways to manage your credit card balance? Visit our guide on getting out of credit card debt.

Frequently Asked Questions (FAQ)

Why does inflation cause credit card interest rates to rise?

As inflation increases, the Bank of Canada raises its policy rate to control price growth. This rate influences how much it costs financial institutions to borrow money. When the policy rate goes up, it becomes more expensive for Canadian banks to access funding. Banks and lenders pass these higher borrowing costs onto consumers, including through higher credit card annual percentage rates (APRs).

Are Canadian credit card rates tied to the Bank of Canada policy rate?

Not directly, but they’re influenced by it. While many credit cards have fixed APRs, lenders adjust rates based on the overall cost of borrowing, inflation expectations, and the credit risk associated with borrowers.

How can I lower the interest rate on my Canadian credit card?

You can request a better APR from your lender, transfer balances to lower-rate cards, or consolidate debt into a smaller interest loan. Remember, though, paying your balance in full is always the most effective way to avoid interest.

Will credit card rates drop when inflation goes down?

They might drop slightly, but credit card APRs tend to stay higher overall. Lenders adjust rates based on multiple factors beyond inflation alone.

Trending Offers

Scotiabank Gold American Express® Card

BMO VIPorter World Elite Mastercard®∗

Tangerine World Mastercard

Tangerine Money-Back Credit Card

BMO VIPorter Mastercard®∗

Scotiabank Preferred Package Chequing for Student and Youths

What's on this Page

- What Is Inflation?

- How Inflation Drives Interest Rates Higher

- Why Credit Card Interest Rates Are Sensitive to Inflation

- Impact on Canadian Households

- Strategies to Protect Yourself From Rising Credit Card Rates

- Will Credit Card Rates Go Down When Inflation Cools?

- Final thoughts

- Frequently Asked Questions (FAQ)