Working hard in the background...

Neo Mastercard® Review

Oct 27, 2025 3:23 PM

The Bottom Line

The Neo Credit Card is special because it earns rewards based on whether the merchant is a partner or not. Most of the time, the cashback earned at these partners is the highest possible compared to all other credit cards. However, we don't recommend using this card as your main credit card and suggest using it only at partner merchants. This is because the rewards at non-partner merchants are very small, and most merchants are not partnered with Neo.

Skip to: Detailed Review

on Neo Financial's website

Welcome Bonus

N/A

Annual Fee

$0

Interest Rates

19.99% - 29.99%□ / 22.99% - 31.99%□

Card Details

Interest Rates

Purchase APR

19.99% - 29.99%□

Cash Advance APR

22.99% - 31.99%□

Balance Transfer APR

22.99% - 31.99%

Fees

Annual Fee

$0

Additional Cards

$10 (max 1 additional cardholder)

Eligibility

Minimum Individual Income

N/A

Minimum Household Income

N/A

Credit Score Estimate

Fair

Type

Card Type

Credit

Reward Type

Cash BackPros & Cons

Pros

- No annual fee

- Instant approval and access

- Unique partner cashback program

- Unique benefit system

- Balance protection

Cons

- Insurance and benefit fees

- Spending caps

- Low cashback rates

Our Detailed Review

When it comes to the Neo Mastercard, there are people who absolutely love the card and those who don't.

With this in mind, we often refer to the Neo Mastercard as a situational card. Based on unique spending habits, some people should definitely apply for it, and others might be better off with a different card.

In this post, we'll dive deep into every aspect of the Neo Mastercard. In the end, if you decide to apply, the "apply now" buttons on this page will give you an exclusive signup bonus.

Let's get into it!

How You Earn Rewards With The Neo Mastercard

The Neo Mastercard has a unique reward system, just like the other Neo credit cards on the Canadian market.

Most credit cards simply give you cashback based on the category of your purchases.

The Neo Mastercard, for example, gives you:

- 1% cashback on groceries

- 1% cashback on gas

But here's how the Neo Mastercard takes things a step further ...

With this card, you can also earn up to 15% cashback on Neo Partner purchases. Neo's cashback offers differ from partner to partner, but on average, you can expect to earn about 5% cashback on eligible purchases.

Neo has over 10,000 partners across Canada, making it easy to optimize some of your most common expenses like gas, groceries, dining, subscription services, and more!

Redeeming Your Neo Mastercard Rewards

Thankfully, your Neo Mastercard cashback becomes available for cash out once you've earned at least $1 back.

To retrieve your cashback, simply:

- Log in to either the Neo app or member.neofinancial.com

- Tap your Rewards Wallet

- Select Cash out

- Choose where you'd like your cashback deposited

You can use your Neo Mastercard cashback to pay off your credit card balance, add it to your Neo Everyday account, or redeem it towards merchandise available through the Neo store.

Comparison to Other No-Fee Cashback Credit Cards

In the previous section, we mentioned the existence of other no-fee cashback credit cards a couple of times. In this section, we're going to actually compare the Neo Mastercard to other top-ranking no-fee cashback credit cards on the Canadian market.

Here's a sneak peek of the comparisons we'll be making:

| Rogers Red World Elite® Mastercard® | Tangerine® Money-Back World Mastercard®* | Simplii Financial™ Cash Back Visa* Card | SimplyCash® Card from American Express | Neo World Mastercard® | |

|---|---|---|---|---|---|

Welcome Bonus | N/A | $120 bonus after spending $1.5k in 3 months†† + 1.95% balance transfer promo rate for 6 months† | 8% cash back† up to $1,000 in spending | Up to $100 in Statement Credits | N/A |

Earn Rates |

|

|

|

|

|

Insurance Included | 7 types

| 4 types

| 2 types

| 3 types

| 2 types

|

Benefits | 2 benefits

| 3 benefits

| None | 1 benefit

| None |

Annual Fee | $0 | $0 | $0 | $0 | $0 |

Income Requirements | $80,000 personal or $150,000 household | $50,000 personal or $80,000 household | $15,000 household | N/A | $50,000 personal or $80,000 household |

Apply Now | Learn More | APPLY NOW | APPLY NOW | APPLY NOW | APPLY NOW |

Neo Mastercard vs Rogers Red World Elite Mastercard

If part of the appeal of the Neo Mastercard for you was the option to get your hands on some travel insurance, then you'll be really pleased with the Rogers Red World Elite Mastercard. Unlike the Neo Mastercard, the Rogers Red World Elite Mastercard includes valuable coverage categories like trip interruption and trip cancellation insurance, all at no extra cost. You can also pocket benefits like an airport lounge Dragon Pass membership without paying a monthly fee.

Additionally, this World Elite alternative grants cardholders more upfront cashback on both USD and non-USD purchases, especially if you're a qualifying Rogers, Fido, Comwave, or Shaw customer. The catch? You'll need to meet some high annual income requirements to qualify. Get the full breakdown in our Rogers Red World Elite Mastercard Review.

Ultimately, The Rogers Red World Elite Mastercard is a better choice for those who don't shop at Neo Partners and who have an eligible service to boost their cashback rates, not to mention those who want travel insurance and benefits for free.

Neo Mastercard vs Tangerine World Mastercard

If you'd like a little more control over which categories earn you cashback on, the Tangerine World Mastercard might be the card for you. This Mastercard allows you to pick 2 cashback categories out of 10, including gas or groceries, plus a third if you deposit your rewards into a Tangerine Savings account.

This competitor also provides coverage like extended warranty, purchase protection, car rental, and mobile device insurance, plus a Dragon Pass membership, all at no additional cost. That said, you'll need to meet some annual income requirements to qualify for this customizable contender. Learn more by reading our Tangerine World Mastercard Review.

Therefore, the Tangerine World Mastercard is best suited to those who want to optimize miscellaneous spending categories, especially if they don't shop at Neo Partners. This card also provides insurance coverage and benefits for free.

Neo Mastercard vs Simplii Financial Cash Back Visa Card

If you want automatically higher cashback rates on eligible restaurant, bar, and coffee shop purchases, without having to rely on Neo Partners, then the Simplii Financial Cash Back Visa Card might pique your interest. This card also optimizes gas and grocery purchases at a higher initial rate, and adds drugstore and pre-authorized payment optimization.

To top it off, cardholders can expect included extended warranty and purchase protection insurance. Just note that there are some small annual income requirements that you'll need to meet to qualify. Find out more in our Simplii Financial Cash Back Visa Card Review.

All in all, the Simplii Financial Cash Back Visa Card is a good alternative to the Neo Mastercard if you want better flexibility on your dining earnings and superior initial cashback rates on gas and groceries. However, if you happen to dine, fuel up, and purchase groceries at Neo Partners, then the Neo Mastercard might still be worth it.

Neo Mastercard vs SimplyCash Card from American Express

If you want better cashback on gas and groceries up-front, then your best no-fee contender may be the SimplyCash Card from American Express, unless of course you purchase gas and groceries from Neo Partners and intend on staying within monthly spending caps.

That said, the Simply Cash Card also includes travel accident insurance, plus extended warranty and purchase protection insurance, all for no added fee. Not to mention Amex Experiences benefits! Get all the details in our SimplyCash Card from American Express Review.

Like the Neo Mastercard, the SimplyCash Card from American Express also avoids annual income requirements.

In conclusion, the SimplyCash Card from American Express is a solid alternative to the Neo Mastercard if you don't purchase gas and groceries from Neo Partners and you want included coverage and perks.

Neo Mastercard vs Neo World Mastercard

Maybe you do shop at Neo Partners often. In that case, you might want to swap your Neo Mastercard for the Neo World Mastercard instead, also available for no annual fee. This upgraded Neo product offers better cashback on groceries, gas, recurring purchases and all other purchases with higher monthly spending caps. You can also increase your earning potential in these categories by shopping at Neo Partners. Unlike the Neo Mastercard, the Neo World Mastercard also includes extended warranty and purchase protection insurance. The main caveat then is that the Neo World Mastercard comes with some annual income requirements. Read more in our Neo World Mastercard Review.

At the end of the day, the Neo World Mastercard is the next step up from the Neo Mastercard for those who shop frequently at Neo Partners, but you can only get your hands on it if meet the annual income requirements.

Final Verdict

All things considered, if you have a lower-income and intend on making frequent purchases at Neo Partners, then the Neo Mastercard may be for you.

If you intend on purchasing from Neo Partners regularly and have a higher annual income, you can also consider the Neo World Mastercard for better initial cashback rates.

If you don't plan on purchasing from Neo Partners at all, then consider one of the other no-fee cashback credit cards mentioned above for better overall value.

Benefits and Perks

4 Benefits of the Neo Mastercard

To help you decide whether the Neo Mastercard is a good fit for your financial lifestyle, we've listed all of this contender's available perks below:

1. No Annual Income Requirements

Unlike many no-fee cashback credit cards with tempting earning potential, the Neo Mastercard doesn't have any annual income requirements, making it both affordable and accessible.

2. No Annual Fee

One unique aspect of the Neo Mastercard is that it's FREE annually. So you don't need to worry about paying anything monthly or if your reward value is offsetting the cost of the card.

Note, however, that there is a small fee for an additional card/cardholder.

3. Extra Cashback at Neo Partners

As previously mentioned, the Neo Mastercard, like other Neo credit cards, provides cardholders with additional cashback-earning opportunities through their retail partners.

The amount of cashback you receive on partner purchases depends on the partner in question. The average amount of cashback you'll receive is about 5%, but you can earn as high as 15% back. In some cases, there are partners that provide higher promotional cashback rates on first-time purchases.

The best part about this bonus cashback system is that you'll earn partner cashback on top of the Neo Mastercard's initial cashback rates. For example, if you shop at a partnered grocery store, like Loblaws, you'll earn the partner cashback rate as well as Neo's specialized rate on grocery purchases.

4. Flexible Benefits

Similar to Neo's reward system, their benefits system is also unique.

They have a series of perks that you can subscribe to for a monthly fee, offering a flexible way to opt in and out of add ons.

The main difference between Neo benefits with other cards is that other cards have fixed benefits. Meaning that from the moment you get them, the benefits don't usually change. Because of this, some of the better benefits are only available with the more expensive cards.

But with Neo, you have the option to subscribe to a benefit, and when you are done using it, you can cancel your subscription! This will give you the highest return on your money.

You can subscribe to benefits like Neo's Premium Plan, Travel perks, Mind & Body perks, Mobile & Personal Protection perks, plus balance protection.

Here's a small summary of the card's different perks and benefits:

For $4.99/Month, you can upgrade your card to Neo's Premium Plan for some additional features and cashback.

With this add-on, you can receive:

- Extra cashback on all your purchases, not just those from Neo partners

- Bonus cashback on specialized categories like gas and groceries, as well as exclusive offers from Neo Partners in the following categories:

- Restaurants, bars, and cafes

- Popular streaming services

- Food delivery services

- Retail shops (online and in-store)

- Purchase protection and extended warranty insurance (although, this isn't all that impressive since there are many other no-fee cards that offer these coverage categories)

- AI-powered insights with enhanced data

- Group life insurance

- 24/7 legal assistance

- Dedicated priority support

The most intriguing part of the Premium Plan is the boosted cashback across the Neo partner network. If you purchase frequently from Neo partners, you'll get a big increase, making the $4.99/month cost more than worth it.

For $4.99/month, you can get access to many travel-related benefits and insurance perks. Since you can opt in and out of this add on, you can make the most out of it by subscribing before you go on your trip, then cancelling the subscription once you return home.

Specifically, this benefit includes:

- A Priority Pass membership

- SmartDelay, allowing you to access airport lounges when takeoff is delayed

- Insurance coverage such as emergency medical insurance, flight delay insurance, car rental insurance, and trip interruption and trip cancellation insurance (full details here)

- Cashback on foreign transactions

- Travel cashback opportunities from Neo Partners (earn cashback on flights, hotels, car rentals, and more)

More details are available through the Neo app or member.neofinancial.com.

Coverage like trip interruption and trip cancelation insurance are rare benefits that even some paid cards fail to offer. With this in mind, being able to get these perks for only $5 is an absolute win if you already don't have travel coverage.

Neo financial's Mind & Body perks allow you to access fitness and wellness apps, classes, and programs including FitOn PRO, Headspace Plus, and sessions at Oxygen Yoga & Fitness.

You can subscribe to Mind & Body perks, as well as uncover more details on these benefits through the Neo app or member platform.

When you subscribe to Mind & Body perks, you'll receive an email from the benefits provider, Walnut.

When you subscribe to Mobile & Personal Protection perks, you'll unlock features like Dashlane Premium, AKKO, and Cyberscout.

To use and manage these perks, you'll need to set up an account with the benefits provider, Walnut.

Credit card balance protection coverage is an optional add on to your Neo product, but it may be worth it to help cover any monthly minimums or outstanding balances when you've hit a rough patch.

With this perk, you'll be covered in the case of:

- Job loss

- Disability

- Critical illness or death

- Lifetime milestones

See more details here.

Note that like all other add ons, balance protection can be cancelled at any time.

Drawbacks and Considerations

3 Downsides to the Neo Mastercard

At the same time, the Neo Mastercard also has some downsides.

Let's take a quick look at these drawbacks to help you make an informed decision:

1. Low Initial Cashback Rates

If you don't plan on purchasing frequently from Neo Partners, then the Neo Mastercard's cashback rates are less impressive. In fact, in this case, there are other no-fee cashback cards that you could consider instead for better value.

2. Spending Caps on Reward Categories

Another thing to note about the Neo Mastercard's rewards categories is that they come with monthly spending caps. If you suspect that you're going to meet those spending caps each month, then you may want to consider another no-fee cashback card, especially if you don't intend on purchasing from Neo Partners.

3. You Have to Pay for Coverage and Perks

While the flexibility of opting in and out of coverage and perks is enticing to some, others will notice that there are other no-fee credit cards on the Canadian market that include sufficient perks for their spending habits, plus plenty that automatically come with standard coverage like purchase protection and extended warranty insurance.

Frequently Asked Questions

The answer to this question isn't exactly straight forward. As with any credit card, a card is only worthwhile if it complements your unique spending habits.

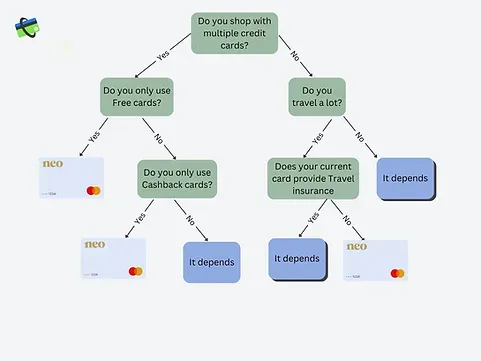

Regardless, to help you quickly conclude whether the Neo Mastercard is for you, we created this flowchart to help you make your decision.

If this chart lead you to a Neo Mastercard, then an application might be worth it. If you reached "It depends" on the chart, then consider this card against alternative options.

For an in-depth comparison against other credit cards on the Canadian market, try our credit card comparison tool.

If 30% of your purchases are from Neo partners, then you are averaging around 1.5% cashback on all your purchases.

If your current card is a cashback card and you are not getting a 1.5% return on average, then go for the Neo Mastercard.

If you are using only cashback or no-fee credit cards, then the answer is yes.

The cashback rate you get on most Neo partners beats the cashback rate you can get from any other card.

But suppose you use a points-based card, particularly a paid one. In that case, you have to decide whether carrying a new card that you occasionally use for a marginally higher return in some cases is worth it or not.

About the author

Sara Skodak

Lead Writer

Since graduating from the University of Western Ontario, Sara has built a diverse writing portfolio, covering topics in the travel, business, and wellness sectors. As a self-started freelance content ...

SEE FULL BIOAbout the editor

Kevin Shahnazari

Credit Card Expert

Kevin started FinlyWealth and juggles a bit of everything—digging into data, running our marketing, and keeping the finances on track. Before this, he spent years as a data scientist at tech companies...

SEE FULL BIOWhat's on this Page

Get personalized rewards estimates — see exactly how much you could earn.

Neo Mastercard® Cash Back Calculator

on Neo Financial's website