Working hard in the background...

Neo Mastercard® Review

Jun 15, 2025 11:42 PM UTC

The Bottom Line

The Neo Credit Card is special because it earns rewards based on whether the merchant is a partner or not. Most of the time, the cashback earned at these partners is the highest possible compared to all other credit cards. However, we don't recommend using this card as your main credit card and suggest using it only at partner merchants. This is because the rewards at non-partner merchants are very small, and most merchants are not partnered with Neo.

Skip to: Detailed Review

on Neo Financial's website

Welcome Bonus

N/A

Rewards Rate

1% - 4%

Cash Back

Annual Fee

$0

Interest Rates

19.99% - 29.99%□ / 22.99% - 31.99%□

Rewards

- 1% cash back on grocery purchases up to $500 spending per month (3% cash back with $5k in a Neo everyday account, and 4% cash back with $10k in a Neo everyday account) - drops to the 0.5-1% cash back tier after hitting spend cap

- 1% cash back on gas purchases up to $500 spending per month (3% cash back with $5k in a Neo everyday account, and 4% cash back with $10k in a Neo everyday account) - drops to the 0.5-1% cash back tier after hitting spend cap

- 0% cash back on all other purchases with $0 in a Neo everyday account, or 0.5% cash back with $5k in a Neo everyday account up to $1,667 spending per month, or 1% cash back with $10k in a Neo everyday account up to $1,667 spending per month - drops to 0% cash back again after hitting spend cap

- +5% earned on average at Neo Partners.

Insurance

Coverage

Balance Protection

optional add on

Benefits

Details

Neo Premium ($4.99/month)

Neo Travel Benefits ($4.99/month)

Neo Food Cashback boost ($1.99/month)

Neo Mind and Body Perks ($9.99/month)

Eligibility

Credit Score

GoodAnnual Income

N/A

Card Details

Interest Rates

Purchase APR

19.99% - 29.99%□

Cash Advance APR

22.99% - 31.99%□

Balance Transfer APR

22.99% - 31.99%

Fees

Annual Fee

$0

Additional Cards

$10 (max 1 additional cardholder)

Eligibility

Minimum Individual Income

N/A

Minimum Household Income

N/A

Credit Score Estimate

Good

Type

Card Type

Credit

Reward Type

Cash BackPros & Cons

Pros

- High cash back on grocery and gas if you're willing to hold at least $5k in a Neo everyday account

- Unique cashback program which earns cashback based on partner instead of purchase category.

- Massive cashback at some partners that any other credit card couldn't beat.

- Unique benefit system where perks could be bought with a monthly fee and cancelled after use.

Cons

- Base Cash back is very low when you do not hold any money in a Neo everyday account

- No built-in purchase protection and extended warranty benefit.

Our Detailed Review

So you may have heard about the Neo Credit Card!

Before we go deeper, I want to mention that there are two Neo Credit cards. Neo Credit is an unsecured card, and Neo Secured Credit is the secured version of this card. Here, I will be reviewing the unsecured version of the card, the Neo Credit! We will discuss the Neo credit card interest rate and ensuring you learn about all pros and cons before deciding.

If you want to learn more about the Neo Secured card, you can read more about it in the Neo Secured card page.

Now back to the Neo Credit Card review:

I have friends who told me that it's the best card they ever had and friends who absolutely hated it.

BUT...

After speaking with them, I found the reason. The Neo credit card isn't for everybody.

It's what I call a situational card. Some people must absolutely have it, and some might be better off with a different card.

In fact, I have Neo Credit, and use it to maximize the rewards I earn from my credit cards.

In this post, we will go deep into every aspect of the Neo credit card and review everything so you know if you should apply for this card or not. In case you decide to apply, the apply now buttons on this page will give you an extra signup bonus you wouldn't have gotten otherwise.

Is The Neo Credit Card Good? Should I get it?

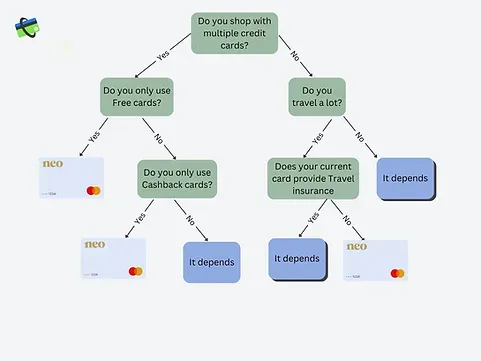

The answer to this question is not that straight forward. To make things easier, I created this simple flowchart that you can follow to help make your decision.

Now if you reached a Neo Card, then the decision is easy.

If you reached "It depends", I will elaborate further to help you make the final decision.

Neo Credit Fee

One unique aspect of Neo credit cards is that they are FREE. So you don't need to worry about paying anything each month or whether the rewards you are getting are offsetting the cost of the card.

Neo Credit Cards Unique reward system

Neo Credit cards have a unique reward system.

And by unique, I mean there is not a single credit card out there in Canada that even comes close to what Neo offers.

Other credit cards give you cashback based on the category of your purchases. For example, a card may give you 1% cashback on all food and drink purchases.

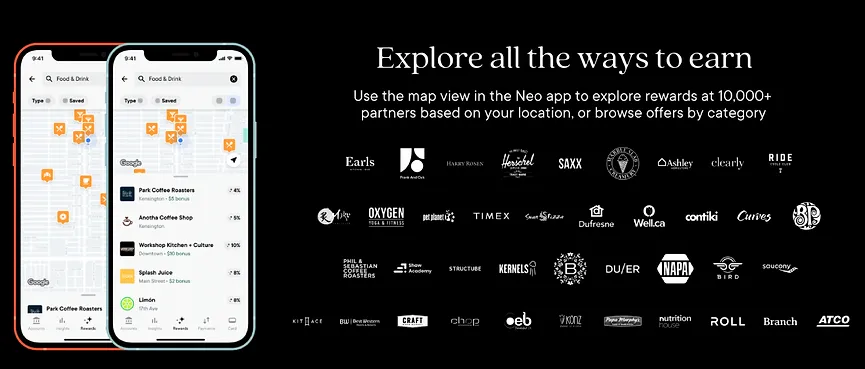

But Neo is different. Neo's cashback differs from partner to partner. So, for example, if you go to a restaurant, you might get 5%, and if you go to another, you might get 0.5%. Neo has over 10,000 partners across Canada, from small businesses like your local coffee shop to massive stores like Walmart. The list includes many retail favorites in Canada, like Lululemon, Aritzia, Canadian Tire, and more.

This system has its own advantages and disadvantages.

The biggest downside of Neo Credit cards is that you don't get any cashback on your purchase if the merchant is a non-Neo partner. (Except In some rare cases, you might trigger a 0.5% cashback guarantee on your overall purchases, which does not happen often.

So there is not much incentive to use Neo Credit cards at non-Neo partners!

But the most significant upside is that if the merchant is a Neo partner, the cashback return will beat almost any other credit card. While with most free cashback credit cards, you get around 1%, and with paid cashback cards, you might earn 3% in some categories, with Neo, you can get an average of 5% when shopping with its partners, which is a massive win!

To help you find Neo partners and see what their cashback rates are, we have listed the top merchants in Canada in different categories and added if they are Neo partners or not and what their cashback rate is here.

Now, with this in mind, let's answer some of the questions that might not have been answered in the flow chart.

Should you get the Neo Credit if you only shop with one credit card?

The easy rule is that if 30% of your purchases are from Neo partners, then you are averaging around 1.5% cashback on all your purchases.

If your current card is a cashback card and you are not getting a 1.5% return on average, then go for Neo.

If you shop with multiple credit cards, should you get Neo Credit?

If you are using only cashback or Free credit cards, then the answer is definitely yes.

The cashback rate you get on most Neo partners beats the cashback rate you can get from any other card.

But suppose you are a person that uses point-based cards, especially a paid one. In that case, you have to decide whether carrying a new card that you occasionally use for a marginally higher return in some cases is worth it or not.

Neo Credit Card - Benefits at a Premium

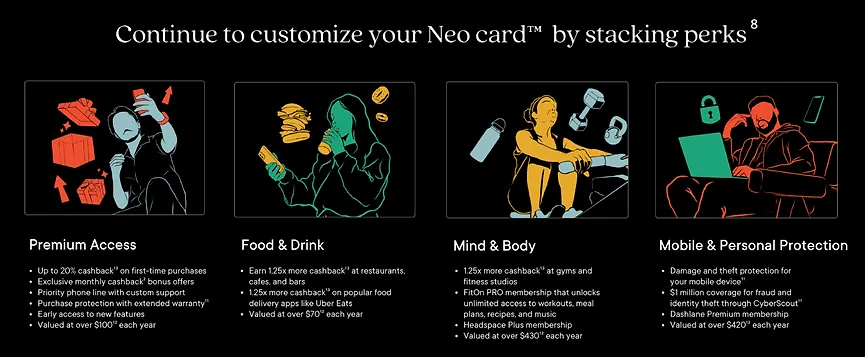

Similar to Neo's reward system, their benefits system is also unique.

They have a series of perks that you can subscribe to for a monthly fee. Here's a small summary of their different perks and benefits:

The main difference between Neo benefits with other cards is that other cards have fixed benefits. Meaning that from the moment you get them, the benefits don't usually change. Because of this, some of the better benefits are only available with the more expensive cards.

But with Neo, you have the option to subscribe to a benefit, and when you are done using it, cancel your subscription! This will give you the highest return on your money.

Before we go into the benefits you can subscribe to, I have to point out one of the biggest disadvantages of Neo credit cards. While almost every free and paid credit card comes with purchase protection and extended warranty insurance, Neo credit cards don't have that, and there isn't even an option to subscribe to them.

Now most people I know have never used either of their benefits in their life, so if you are part of this group, then you don't need to worry.

But if these two benefits are crucial to you then Neo might not be for you!

Neo has five perks: Premium, food and drink, Mind and Body, Travel, and mobile & personal protection.

1. Premium

For $4.99/Month, you basically upgrade your card so that you get some extra features and cashback. With this benefit, you get cashback (0.5%) on all your purchases and not only on the ones that are Neo partners, and you also get Purchase Protection and Extended Warranty.

I would say these are not as impressive because there are many other free cards out there that offer these.

The part that is more interesting is the boosted cashback rate across the Neo partner network, especially on food and services. If you buy a lot at these Neo partners, you will get a big increase, making the $4.99/Month more than worth it.

Based on this information, you can decide whether this perk is worth it for you or not. It might be an absolute must-have for some and something not that impressive for others.

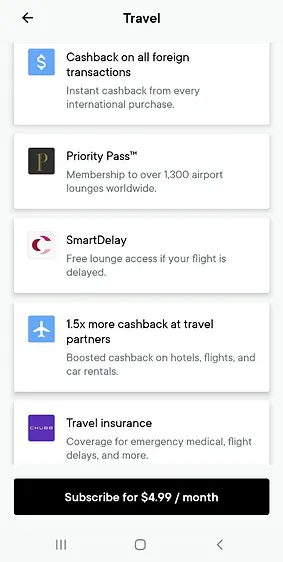

2. Travel benefit.

For $4.99/month, you get access to so many travel-related benefits and insurance. So before you go on your trip, you can simply subscribe to these benefits, and once you come back from your trip, go ahead and cancel it.

What's more impressive is that the travel insurance even has trip cancelation and trip interruption insurance on top of the other coverages.

Travel cancelation and trip interruption benefits are rare benefits that even some paid cards don't offer, and being able to get this for only $5 is an absolute win if you already don't have this insurance.

So that's why if you travel a lot and none of your cards have travel insurance, then you can get Neo and use this benefit when you are traveling!

Neo Credit card - Pros and Cons summary

What are the real benefits/pros of the Neo Credit card?

- Average of 5% and guaranteed minimum of 0.5% cash back at Neo partners

- Relatively easy to get approved (low credit score, no income requirement)

- No monthly fees (unless you opt-in for subscriptions)

- Top-of-the-line mobile app that helps track your spending, rewards, and card status

- Access to cashback instantly (can redeem cash back at any time)

What are the real cons to the Neo Credit card?

- No included insurance coverage or consumer protection. However, add-on subscriptions can be purchased for a certain monthly fee, and can also be canceled at any time.

Neo Credit Card - Conclusion

Neo Credit cards are definitely a unique credit card to have, but they are not for everybody.

If you only use cashback or free cards, then Neo is something you want to have in your arsenal.

In addition, if none of your current credit cards offer any travel insurance, Neo credit cards offer travel insurance for a very small fee.

What's on this Page

- The Bottom Line

- Card Details

- Pros & Cons

- Our Detailed Review

- Is The Neo Credit Card Good? Should I get it?

- Neo Credit Fee

- Neo Credit Cards Unique reward system

- Should you get the Neo Credit if you only shop with one credit card?

- If you shop with multiple credit cards, should you get Neo Credit?

- Neo Credit card - Pros and Cons summary

- Neo Credit Card - Conclusion

Get personalized rewards estimates — see exactly how much you could earn.

Neo Mastercard® Cash Back Calculator

on Neo Financial's website