Working hard in the background...

How Canadian Small Business Owners Can Benefit from Credit Cards

Published Aug 31, 2025 3:41 AM UTC • 4 min read

Oftentimes, small businesses come with big expenses. That’s why it’s crucial to find a financial tool that helps you manage, optimize, and keep track of your spending.

Thankfully, you can perform all of these tasks using a credit card, even more so when you use a business-oriented credit card, offered by most banks.

Below, we’ve broken down how Canadian small business owners can benefit from credit cards.

Stick around to learn how the right credit card can support your business growth.

How a Credit Card Can Benefit Your Small Business

Before committing to your business credit card, you’ll want to brush up on how a credit card can benefit your small business in the first place.

Here are some of the perks you can expect:

- Expense management and tracking. With the right business credit card, you can manage and oversee your company’s daily spending habits. In addition to expense management, your business credit card can also help you continually track your expenses through your credit card statement. Reviewing your spending habits frequently allows you to spot patterns, scope out overspending, and build a better budget.

- Steady cash flow. Keeping up with your company’s cash flow can be challenging, but with a business credit card and short-term financing, you’ll have peace of mind during those lulls between purchasing inventory, compensating suppliers, and earning revenue.

- Rewards. What better way to boost your revenue than to tap into a credit card rewards program? Many business credit cards allow you to earn points or cashback on eligible purchases. These rewards can later be redeemed towards future expenses like travel.

- Insurance coverage. Besides purchasing power, business credit cards also tend to come with various forms of insurance coverage, like purchase protection or extended warranty insurance. Some business credit cards are also equipped with travel insurance like trip cancellation insurance or emergency medical coverage when you need to take your business abroad.

Read More: How Does a Business Credit Card Work

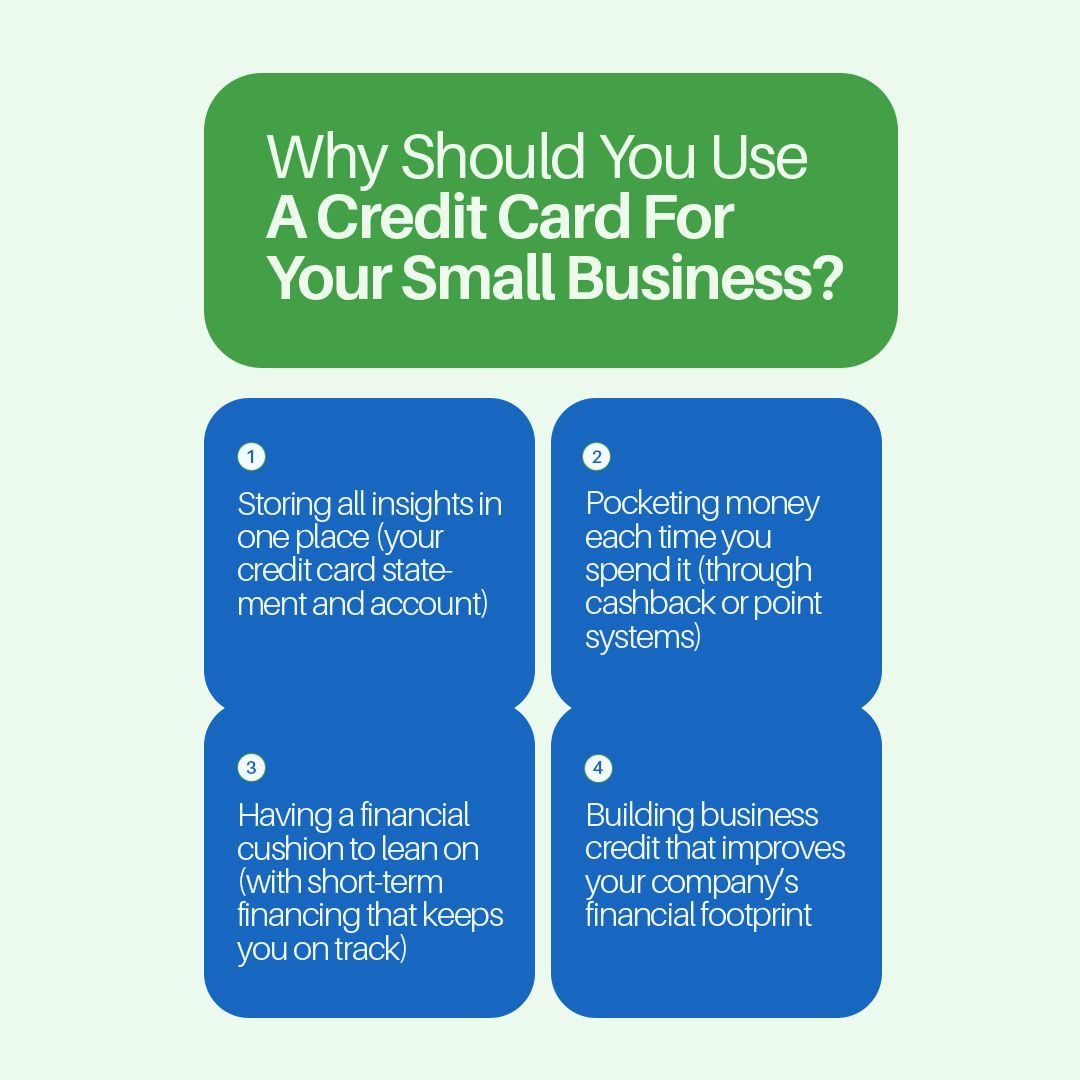

Why Should You Use a Credit Card For Your Small Business?

Based on the above points, Canadian small business owners should seriously consider using a credit card for their company’s financial health.

By using a small-business-friendly credit card, you can successfully manage, optimize, and track your cash flow.

Ultimately, some of the highlights of doing business with a credit card include:

- Storing all insights in one place (your credit card statement and account)

- Pocketing money each time you spend it (through cashback or point systems)

- Having a financial cushion to lean on (with short-term financing that keeps you on track)

- Being backed by insurance categories that cover products, warranties, and/or travel expenses

- Building business credit that improves your company’s financial footprint

How to Select the Right Small Business Credit Card

Now that you understand the advantages of having a small business credit card, it’s time to cover how to choose the right card for your company.

Most banks offer business-specific options for their customers, including the Big 5:

American Express also has some business contenders available to Canadians.

When selecting the right small business credit card for you, make sure you:

Match Spending Habits to Reward Categories

Analyzing where the majority of your money is going is a good way to assess which credit card will complement your spending habits the most.

There are a couple of Canadian options that will earn you a flat rate of points or cashback on all purchases, while others might optimize specific spend categories like travel, gas, or dining.

Likewise, specifically when dealing with a points card, you’ll want to double-check that the card’s redemption categories match your spending patterns as well. For example, if travelling isn’t a common business expense, you might not want to opt for a credit card with rewards that are best redeemed towards future trips.

Look Out for Enticing Intro Offers

Many times, credit cards will incentivize applicants by offering welcome bonuses of extra rewards or cashback, perks, or upgrades.

For some of these offers, you’ll need to meet minimum spending requirements to collect your promotional prize(s), which is why you may want to time opening your account with larger expenses.

Browse the Added Benefits and Coverage

Plenty of business-focused credit cards also come with added benefits and coverage. Expect everything from travel benefits to interest free periods to coverage for purchases and upcoming business trips.

Consider Any Annual or Additional fees

Of course, many credit cards with valuable rewards and perks come with added fees – whether that be an annual fee or higher interest rates on carried balances.

An annual fee is justifiable if the card has high annual value and if you intend to reap all rewards and benefits to their full potential.

If you plan to use your credit card like a business loan and expect that you might carry a balance, note that interest rates tend to be higher unless you specifically opt for a low-interest credit card or apply for a business card with an interest-free period as a perk.

Conclusion

As a small business owner, based on your ability to track, manage, and optimize your company’s spending, you should absolutely make use of a credit card in your business.

Now that you’re well-versed on how Canadian small business owners can benefit from credit cards, don’t wait, find your new business partner today!

Frequently Asked Questions

Why should you use a credit card for your small business instead of a debit card?

Compared to debit cards, business credit cards come with more advantages. Business credit cards allow you to build business credit, manage cash flow, and many credit cards also include reward programs and insurance coverage, features that debit cards typically lack.

How do you choose the right credit card for your business?

You’ll always want to start by reviewing your spending patterns to help you select the right business credit card. Once you’ve identified where your company tends to spend money, you can find a credit card with a rewards program that complements and optimizes those habits. Keep an eye out for reward-boosting welcome bonuses, reasonable annual fees, and other complementary benefits when submitting an application.

Do business credit cards affect your personal credit score?

Not all business credit cards in Canada report to commercial credit bureaus. Some only affect your personal credit history because they require a personal guarantee. To check, ask your issuer where they report activity, review your cardholder agreement, and monitor your company’s profile with Equifax Commercial or Dun & Bradstreet. If building an independent business credit history is important for your future financing needs, choose a card from an issuer that reports to commercial bureaus.

Are annual fees worth it for a small business credit card?

If the value of the credit card’s rewards and benefits outweigh the value of the annual fee, then you’ll essentially offset the yearly cost of the card.

About the author

Sara Skodak

Since graduating from the University of Western Ontario, Sara has built a diverse writing portfolio, covering topics in the travel, business, and wellness sectors. As a self-started freelance content ... See full bio

Trending Offers

Scotiabank Gold American Express® Card

BMO VIPorter World Elite Mastercard®∗

MBNA Rewards World Elite® Mastercard®

BMO VIPorter Mastercard®∗

Tangerine World Mastercard

Tangerine Money-Back Credit Card