Working hard in the background...

How New Canadians Can Avoid Hidden Fees on Credit Cards

Published Sep 9, 2025 2:51 AM • 5 min read

If you’re a newcomer to Canada, chances are you’re juggling a lot. Everything from opening a bank account to setting up a cell phone plan to maybe even applying for your first Canadian credit card.

If you’ve managed to check off all of those tasks, great work! That said, there’s something else to consider. Many Canadians don’t initially realize that credit cards often come with hidden fees.

In this guide, we’ll walk you through the most common hidden credit card fees in Canada, including tips on how to avoid them in the first place.

What do new Canadians need to understand about credit card fees?

Credit cards do more than allow you to pay for your daily essentials. They can also help you build a credit history in a new country. Not only can they benefit you by establishing a credit score, but they may even allow you to earn rewards or better manage your cash flow. However, these benefits can come with a cost, and those associated credit card fees can add up quickly. These costs don’t just impact your monthly budget; they can also hurt your credit score if they lead to missed payments or surprise interest charges.

As a newcomer, building credit in Canada is one of the smartest financial moves you can make. But doing so without understanding the hidden costs can lead to unintended consequences and financial distress.

Common hidden credit card fees in Canada

Many credit cards come with associated fees and additional costs. To be sure you don’t fall victim to hidden charges, look for the following on your card:

· Foreign transaction fees (aka FX fees)

Most Canadian credit cards charge a 2.5% to 3% fee on purchases made in a foreign currency. This includes when you shop online with international websites, as most of us do. This can be true even when the prices are displayed in Canadian dollars!

How to avoid it: Pay in CAD only! Of course, this isn’t always realistic, so it can be helpful to find a credit card that doesn’t charge foreign transaction fees. Luckily, a few Canadian banks offer no-FX options.

· Annual Fees That Don’t Add Value

Who doesn’t love premium perks? I know I do! Sometimes, however, these benefits aren’t worth the cost. Some credit cards charge annual fees of $120 or more, so unless you're using all the benefits, that cost may not be worth it.

How to avoid it: Look for no-fee credit cards or cards that offer a first-year fee waiver.

Tip: Don’t forget to compare perks versus costs before signing up and consider downgrading your card to a more affordable option if needed.

· Balance Transfer Fees

You might want to transfer your credit card balance from one card to another, but make sure you consider the cost of doing so. While you may receive a low promotional interest rate on the new card (hello 0% teaser rate!), there is often a transfer fee charge of 1-3%. These fees are not always obvious until after you apply for the transfer and it’s too late to reconsider. Additionally, many impressive balance transfer promotional offers expire after a few months, often reverting back to less favourable interest rates afterwards.

How to avoid it: Read the fine print before accepting a balance transfer offer. Do the fees outweigh the potential interest savings? If so, walk away!

Tip: Want to explore options for paying off credit card debt? Get the guide here.

· Cash Advance Fees

Banks often charge cash advance fees when you swipe your credit card at an ATM. Not only are you responsible for covering that charge, but you will also start collecting high interest immediately. That’s right, there’s no grace period!

How to avoid it: It’s usually best NOT to use your credit card when making cash withdrawals. Start to build an emergency fund that you can rely on instead!

· Over-limit Fees

Going over your credit limit by a dollar or two isn’t the end of the world, right? Unfortunately, it is a BIG deal for the banks. This is why many credit cards have resulting fees when you exceed your credit limit.

How to avoid it: It’s easy to overspend when you don’t realize how much you’re charging to your card. Set up alerts to monitor your credit usage. Luckily, some issuers will even decline charges that exceed the limit, prohibiting you from going over.

· Paper Statement Fees

Still getting snail mail? Should you choose to receive a mailed paper credit card statement, you may be subject to an additional charge.

How to avoid it: Go paperless! You can download a PDF copy of your statement from your online banking to save some cash or opt for e-statements. Just be sure to check your account regularly to monitor your transactions and payment due dates.

· Inactivity Fees

Some Canadian credit cards charge a fee if you don’t use your card frequently.

How to avoid it: Be sure to use your card at least once every few months to maintain its active status. Consider putting a small subscription on each card, for example. Just be sure you pay off the charge each and every time!

How to Read the Fine Print on Credit Cards in Canada

Grab your cardholder agreement. You know, that document you probably just tossed into your filing cabinet, because now is the time to actually read it! Understanding the fees on your credit card starts with examining this document to ensure you don’t get hit with any surprise fees. For example, check the sections “Other Fees” and “Additional Charges.” Be sure to note the promotional rate expiry date to avoid an unexpected jump in costs.

Now, what happens if you don’t understand the jargon? There is no shame in asking. Reach out to a representative at your bank branch or consider contacting customer service with any questions. Most Canadian banks offer multilingual support to help newcomers navigate credit terms.

Tip: Compare card terms using online resources like our Best Credit Card Finder tool.

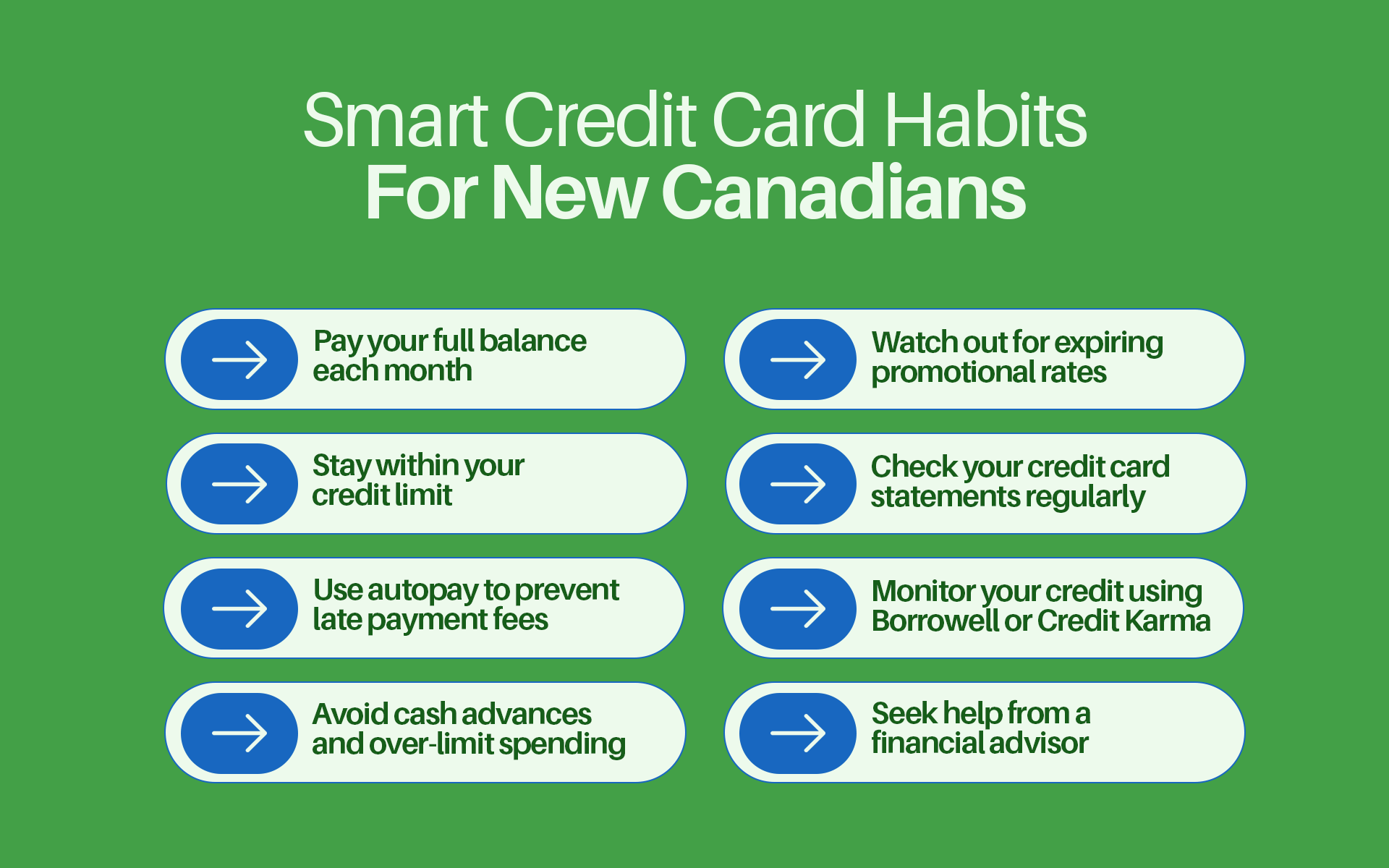

Smart Credit Card Habits for New Canadians

Avoiding fees doesn’t mean avoiding credit. Instead, it means using it in a smarter way. A bit of planning can help you build a healthy credit history while steering clear of unnecessary costs. Consider the following tips to build credit while minimizing fees:

- Pay your full balance each month to avoid unnecessary interest costs.

- Stay within your credit limit and keep your credit utilization ratio under 30%.

- Use autopay to prevent late payment fees.

- Avoid cash advances and over-limit spending.

- Check your credit card statements and online transactions regularly for unfamiliar charges. Consider using digital statements to skip paper fees.

- Watch out for expiring promotional rates that will jump after 6 months or a year.

- Monitor your credit using Borrowell or Credit Karma. Seek help from a financial advisor if you are worried about your credit score.

The Bottom Line: Avoiding credit card fees starts with awareness

Credit cards can help you build a solid financial foundation in Canada. However, the small fees you may not notice can add up in the long run. As a newcomer, being aware of fees and choosing the right card for your situation is one of the best financial decisions you can make - you can always upgrade later if you want!

By understanding your credit card terms, comparing products, and sticking to smart credit habits, you can build a solid credit history without overpaying. Being fee-aware now sets you up for financial success later.

Frequently Asked Questions (FAQ)

What are the most common hidden fees on Canadian credit cards?

In Canada, hidden credit card fees may include those on foreign transactions and cash advances. Other common costs include: annual fees, inactivity charges, and additional costs for paper statements. These costs can add up quickly! Always read the fine print and compare terms before applying for a new card.

How can I avoid foreign transaction fees as a newcomer in Canada?

To avoid additional costs, look for a credit card that does not charge foreign transaction fees. These cards are especially beneficial if you shop online with international retailers or if you travel frequently. Cards like the Scotiabank Passport Visa Infinite Card (more details here) are popular among newcomers for this reason.

Do I need to pay an annual fee to build credit in Canada?

No, you don’t. Most no-fee credit cards or cards with first-year fee waivers still report your activity to credit bureaus. This means they can still help you build a strong credit score in Canada. Choose a card with benefits you’ll actually use and skip the ones with high annual fees and benefits that don’t add value for you.

What are some tools I can use to track and improve my credit as a Canadian newcomer?

Tools like Borrowell and Intuit’s Credit Karma let you monitor your credit score, track your progress, and get alerts for unusual activity. This can be especially helpful for newcomers who want to stay on top of their credit while avoiding unnecessary fees.

Trending Offers

Tangerine® Money-Back World Mastercard®*

Tangerine Money-Back Mastercard

BMO Performance Chequing Account

Scotiabank Passport® Visa Infinite* Card

About the author

Lauren Brown

Editor

Lauren is a freelance copywriter with over a decade of experience in wealth management and financial planning. She has a Bachelor of Business Administration degree in finance and is a CFA charterholde...

SEE FULL BIOAbout the editor

Sara Skodak

Lead Writer

Since graduating from the University of Western Ontario, Sara has built a diverse writing portfolio, covering topics in the travel, business, and wellness sectors. As a self-started freelance content ...

SEE FULL BIO