Working hard in the background...

Contactless Payments: A Convenient and Secure Canadian Credit Card Feature

Published Dec 4, 2025 1:56 PM • 5 min read

We live in a time where you hardly ever need paper to pay. With the simple tap of a credit card, cellphone or smart watch, you can make purchases without ever touching a payment terminal.

Thanks to advanced code encryptions, spending limits, and close-proximity transmissions, covering costs using a contact-free credit card or linked device is actually quite safe.

To discover more about contactless payments, including how they work and what keeps them secure, keep scrolling.

So, What is a Contactless Payment?

A contactless payment is a type of transaction that doesn’t require the buyer to touch a payment terminal. Instead, spenders can tap-to-pay by pressing or hovering their card or linked device over a contactless payment symbol. These symbols consist of several vertical waves and usually appear somewhere on the payment terminal itself or on the terminal’s screen.

How do Contactless Payments Work?

Basically, contactless payments work using radio frequency identification (RFID) relayed via near-field communication (NFC) to transmit payment-necessary information between eligible devices in close proximity to each other.

To initiate a contactless payment, simply hold your card or device a few centimetres above an eligible machine’s contactless payment symbol. In some cases, you may actually need to tap the terminal for a successful transaction. Keep the card or linked device in place until you hear a “beep” followed by an approval message.

Canadian Contactless Payment Options

There are a few different contactless payment options available to Canadians, all of which require a qualifying debit or credit card.

Physical Debit or Credit Cards

The most obvious contactless payment option is a physical debit or credit card with an active tap feature. You can identify if your card comes with tap pretty quickly by spotting the contactless symbol somewhere on the back or front of your card. If you see the symbol, this tap-to-pay feature is usually already activated and it can be deactivated by contacting your card issuer.

Linked Mobile Payment Apps

These days, you can technically leave your cash and your card at home and still have a convenient payment method in your back pocket. Many mobile devices allow you to link your debit or credit card to a mobile payment or digital wallet application.

Some popular apps include:

After adding a debit or credit card to your chosen credit card digital wallet, you may need to open that app each time you’re about to make a payment and select the card you’d like to complete your purchase with. Other times, apps like Apple Pay and Google Pay allow you to pay simply by unlocking your device and holding it up to the payment terminal. It is also worth noting that these methods often enable higher transaction limits if used with facial recognition or fingerprints.

Are Contactless Payments Safe?

There are a few advanced precautions that make contactless payments particularly secure.

To ensure the safety of every transaction, contactless payments are protected by:

- Encrypted codes that are uniquely generated each time you tap and expire after each transaction is completed

- Modern technology that is less vulnerable to data breaches or cloning

- Spending limits that restrict how much a contactless payment can cover (i.e. if your card’s contactless spending limit is $250, then the card cannot be tapped for purchases that exceed that dollar amount – which is helpful if your card is stolen)

- Even if your card is stolen and fraudulent purchases are made within your contactless spending limit, most credit cards (and some debit cards) are equipped with fraud protection (i.e. zero-liability policies)

- Proximity restrictions that only allow your card to be read via NFC within a few centimetres of a payment terminal

- Anonymity with each transfer since your personal information is encrypted and only the necessary data required for the purchase is transmitted

Tip: For extra protection, you can purchase wallets, purses, or phone cases with RFID shielding that protects your card against being skimmed by scammers.

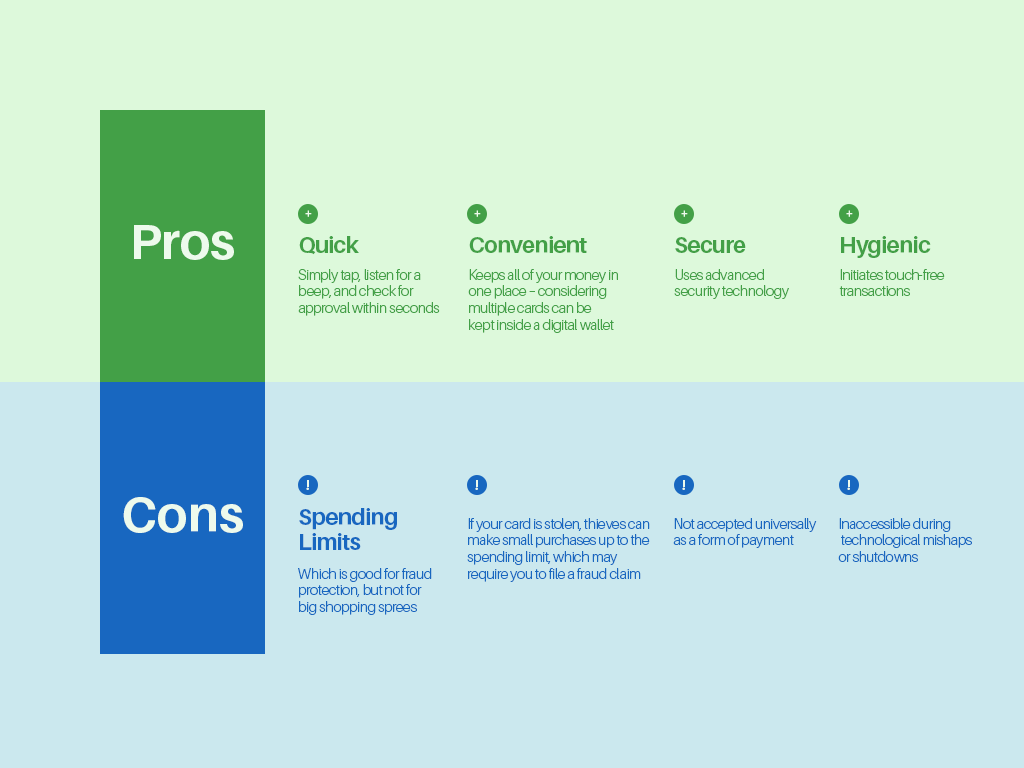

Pros and Cons of Contactless Payments

To help you make an informed decision about whether or not you should take advantage of contactless payments, we put together this pros and cons table:

How to Choose the Right Contactless Credit Card

Countless Canadian credit card issuers offer credit cards with contactless payment features. Choosing the right credit card comes down to finding a contender that complements your spending habits and financial goals.

To make this choice a bit easier for you, we’ve put together a credit card comparison tool that ranks, categorizes, and breaks down all of the top credit cards on the Canadian market. Your search starts here.

Conclusion

Tons of Canadians have shown a preference for tap-to-pay. In fact, more than two thirds of all credit card payments in 2023 were contactless, according to a recent Bank of Canada Survey. This data is unsurprising since tapping a credit card, debit card, or linked device is often a faster, safer, and more convenient way to cover costs.

Frequently Asked Questions

Is there a contactless payment limit in Canada?

Most Canadian card issuers have established a $250 contactless payment limit which applies to individual transactions, not daily totals. In some cases, this can be bypassed when using apps like Apple Pay, however.

What should I do if my contactless card is lost or stolen?

Any time a card is lost or stolen, you should lock that card immediately and report it to your issuer. Most credit and debit card issuers in Canada provide zero-liability fraud protection. This policy ensures that you won’t be held responsible for any covered unauthorized transactions.

Are contactless payments accepted everywhere in Canada?

While most major merchants, establishments, and service providers accept contactless payments, there are some small businesses, independent sellers, or retailers located in rural locations that may require you to insert or swipe your debit or credit card and input your pin to process your payment.

Are there any fees associated with contactless payments?

There are no added fees associated with contactless payments directly. However, there are other fees to look out for, such as foreign transaction fees, depending on where you make your contactless payment and what kind of card you’re using.

Trending Offers

Tangerine® Money-Back World Mastercard®*

Tangerine Money-Back Mastercard

BMO Performance Chequing Account

Scotiabank Passport® Visa Infinite* Card

About the author

Sara Skodak

Lead Writer

Since graduating from the University of Western Ontario, Sara has built a diverse writing portfolio, covering topics in the travel, business, and wellness sectors. As a self-started freelance content ...

SEE FULL BIOAbout the editor

Anthony Coles

Editor

Anthony started off a career in finance working for the largest staging company in the UK. Tasked with setting up a procurement department and costing up large projects building film studios required ...

SEE FULL BIO